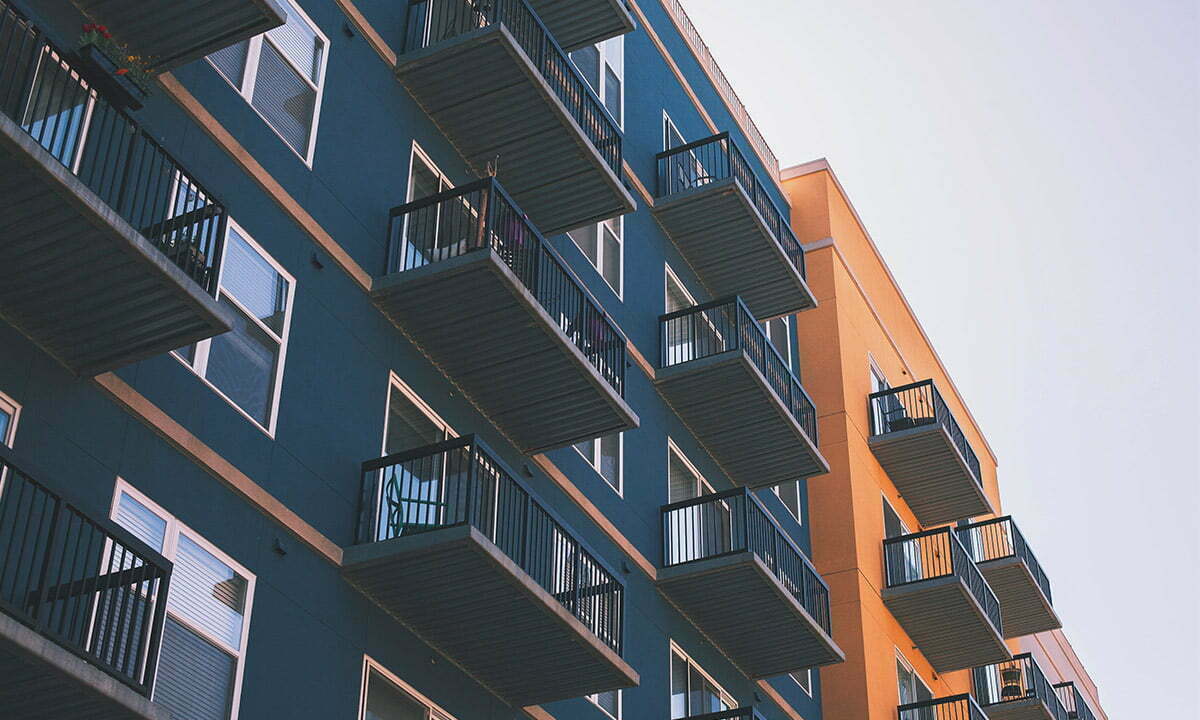

Here we go guys, in this blog, we will be looking for how to rent an apartment with bad credit. Do you have bad credit? Do you want to buy an apartment with it? Well! You are not an average applicant, so you have to do much more.

No worry, because you can make yourself a strong candidate by taking these steps. So, let’s explore all these steps in detail to buy an apartment for rent in Fayetteville, NC.

What Credit Score is Required to Rent an Apartment?

It is important for each investor to maintain a credit score. The reason is that each landlord checks the credit report to know whether the applicant can pay the bills on time. Suppose you have a high credit score. It means your credit profile is at low risk.

Finding and getting ready for new tenants is expensive for landlords. You’re in an excellent position to bargain rent if you’re a dependable, trustworthy tenant and breaking your lease saves the landlord money.

The property landlord checks your credit report. On that basis, he accepts or rejects your application. Commonly the first step is the credit score. But the story doesn’t end here. Your credit report matters a lot.

MUST READ – Best Social Media Platforms To Promote A Small Business

Can You Rent an entire Apartment With Bad Credit?

Yes, it is possible for you to rent an apartment with bad credit. But you need to follow some steps to make it possible. Let’s take a look at these steps:

1. Pay More Upfront

Commonly, you have to pay upfront the first month’s fees. It is important as a security deposit that many landlords ask for. To make a good impression in the eyes of a landlord, you should pay almost three months’ advance payment. Moreover, you can also deposit more security fees. This way, your landlord will get peace of mind.

When you pay more at first, it gets away from the stress of the rental schedule. Moreover, this upfront cost acts as a buffer if you face any challenges in the future.

2. Find a Cosigner

Maybe it is not a simple task to ask someone else to cosign your lease. But this way, you can get an apartment for rent in Fayetteville, NC, if anyone is ready to cosign. Then you must check his credit history. If he has a better credit score, then it is a good option to go for. Moreover, you should explain to your cosigner what both of you are getting into.

Not only this, you should make an agreement with the cosigner. The reason is that the cosigner is at more risk of cosigning. Suppose you fail to follow the agreement. It can be damaging to your credit score and relationship.

3. Bring Documents and References

Don’t think that credit score is the only important factor that can strengthen your profile. In case you have a bad credit score. Then it is good to provide all the documents to buy an apartment for rent in Fayetteville, NC. Make sure to explain the reason for bad credit. The following are some steps that you should take:

- Proof of a responsible rental history

Provide copies of the last rental payment if possible. This way, your new landlord understands that you are a responsible rental. Bank statements are the key to your responsibility.

- Letters of recommendation

You may also ask about recommendation letters from the previous landlord. You can also get a recommendation from business associates, roommates, and management corporations. Make sure to get the letter from reliable sources. Don’t get a letter from your inexperienced friend.

- Pay Stubs as proof of employment

Maybe you have to provide proof of employment to the landlord. So, you must keep the proof of employment for the last few months.

- Utility payments

You should also have proof of utility payments. It is a sign that you are reliable and consistent.

4. Search for Apartments That Don’t Require a Credit Check

Many landlords ask you to show the credit report before they rent an apartment. There are also some landlords that don’t ask you about the credit report. So, it is a good idea to search for apartments that don’t ask you to provide a credit report.

Suppose you want to search for a landlord that doesn’t ask you about your credit score. Then you can search for it on Craigslist, Facebook Marketplace, and newspaper ads. You can also search online thoroughly to find the right provider.

Conclusion:

Though you want to be a strong candidate for buying an apartment for rent in Fayetteville, NC, with bad credit, it is impossible for you. Maybe you are trying to show your landlord that you are the best. But you should also know that his eyes are on your credit report.

Though you have applied the above-mentioned tips, still, you need to make more effort to build your credit report. This way, you can get a better and smooth experience.